'Another budget is needed to get out of crisis'

With the spread of COVID-19 infection, the income of everyone, be it family, business or government, is declining. Whether it is an individual or an organization, the first step everyone can take to manage their income is to reduce wasteful spending. The government has reduced the size of the budget for the coming fiscal year citing the economic crisis due to low revenue, but has not made much effort to control wasteful expenditure.

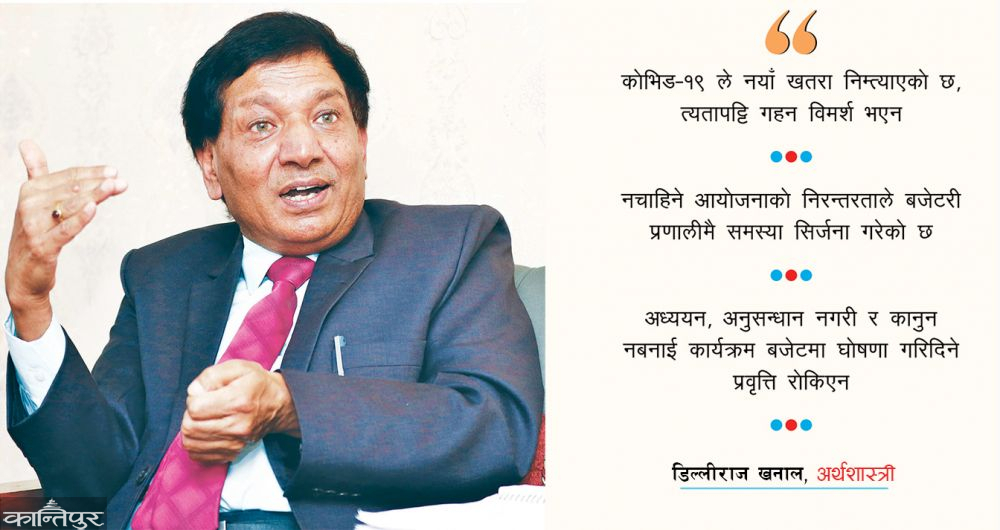

The government did not show readiness during the crisis even in the implementation of the report of the Public Expenditure Review Commission-075, which suggested to reduce the expenditure under normal circumstances and improve the public expenditure system. In this regard , the edited excerpt of the conversation between Krishna Acharya and Yagya Banjade of Kantipur with the Chairman of the Commission Dilliraj Khanal :

How are you looking at the overall economy in the aftermath of the Kovid-19 transition?

In this, we should talk around the data made public by the Central Statistics Department. He has estimated that some areas will be positive and some will be negative. He said economic growth would be 2.28 percent. Now it seems impossible. International donors have estimated further damage. The International Monetary Fund (IMF) has recently said that Nepal's economic growth is only 1 percent. Looking at myself personally, there are two types of situation. Economic growth in 5/6 sectors of the economy - tourism, industry, trade, construction and transportation - is said to be negative. These will be more negative.

Wherever it was said to be positive, there is little possibility of being positive. For example, in agriculture, there will be less economic growth than estimated by the Central Statistics Office. The highest energy growth of 28 percent was said to be in energy, but that was not possible. It was estimated that one thousand megawatts of electricity would be supplied this year. That too has become incompatible. Good economic growth is also expected in areas linked to public spending. But through the mid-term review, the first amendment of the budget and the next amendment on May 30 have shown that the total expenditure will be reduced. Even as stated in the amendment, there will be no expenditure. Other areas are not as expected. All areas are in unfavorable conditions. It is feared that there will be negative economic growth now.

You said that these conditions had already been seen on May 30. Can the budget address these issues?

The topics I have discussed are very unusual. Even more unusual conditions are associated with health and livelihoods. All of these issues are linked to the overall economy. What we call a stagnant economy. In this sense, the current budget should have been transformative. It should have focused on addressing the immediate crisis. We have to give continuity to the old and necessary programs. Only a few issues came up to address this crisis. Overall, the budget did not come out of this crisis.

We had to improve three or four trends from the budget. The most important expense is reform. Our public spending is extremely poor. The Public Expenditure Review Commission also pointed out many issues and said that the expenditure system should be fundamentally changed. Expenses and our economic system have a 'rent seeking' trend. Another short and fast business, from which there is a tendency to make a profit. Policy corruption is linked to groups that eat only rent and profit. Its interrelationship is seen with the parallel informal economy.

The constitution, election manifestos of political parties, budgets, policies and programs and documents also say that the issues I have mentioned will go differently. But in practice those distortions were not corrected. This is the main problem of our economy. Therefore, sustainable, high and quality work has not been done. It has not been possible to make proper use of domestic resources and create employment. This was the issue that the budget had to address. In that case, it would have taken the path of socialism. All organs of government, the policies and programs they take, the pattern of implementation, efficiency and returns are linked to the budget. Budget is not just a matter of revenue and expenditure, There are many policy issues involved. That policy adds to the issue of whether or not the private sector has contributed to the promotion of investment. For that, some work has been done to address some of the problems that have arisen since yesterday. I had said that Rs. 300 billion could be saved if we worked ruthlessly to reduce the expenses. The budget should have gone that way, but it didn't. Covid-19 poses a new type of threat. There was no in-depth discussion.

Are you trying to say that the government's policies and programs are not socialist oriented?

At present, all the 'margin base' rent collection, profit making in a short period of time, policy corruption, parallel informal economy are all working together. Our economic system is operating in the same way. Does that lead to socialism? Analyze yourself. Socialism is about ending social oppression and providing social justice. If those who are deprived of facilities are deprived instead of being given facilities, how can it be called socialism oriented?

The government itself is in financial crisis. Why can't reform be taken?

All this is the result of status quoism. If we look at the statements and documents of the government, we find that we are oriented towards socialism, based on social justice, we have also created employment and we are moving forward on the path of prosperity. It can only be an inner psychology or propaganda. In any case, the attitude seems to be that we are doing the right thing. Criticism, criticism has shown that poverty has been reduced and high economic growth has been taking place for the last two or three years. This kind of thinking and tendency is becoming more and more prevalent.

The Finance Minister may not have misunderstood the statistics of progress and misery. But why is this happening?

It became a matter of systemic shortcomings rather than one person. At present, the improvement of public expenditure, which is like pouring water on sand, has hit the concerned ministry, department or the concerned project and office at the lower level. The work of making it efficient, economical and result-oriented is connected with the Ministry through the concerned office. It needs to be improved overall. It is the finance minister who prepares the result-oriented budget, it is the finance minister who will work in its driving seat. This is an issue related to the entire government including the finance minister. This is a matter of system. It is also associated with political will.

What needs to be improved from the budget?

There are 7/8 topics suggested by our own study and analysis. After federalism, the Public Expenditure Review Commission worked under my leadership. Therefore, it was a big weakness not to cut the expenses as suggested. Expenditure is not linked to results. We need to know what the expenses are for and what the consequences will be. That is not As a result, the goals and achievements set by the budget will not be achieved. The trend of remittances, spending at the end of the year will continue this year and next. The organizational structure of public bodies has not been improved. There are many departments, offices that are easy to spend, there are boards, there are committees. Why do you need drinking water in the center? If the Public Expenditure Review Commission rejects it, billions of rupees have been allocated to one committee. Offices have been set up in the federal structure in a double or triple manner. According to the constitution, the right to be given below has been placed above.

On the other hand, all kinds of expenses have been linked to projects and projects. Similarly, budget is allocated. This is a practice not found anywhere else in the world. The budget allocated for general office operation, general public service, defense, police, peace and security and constitutional provisions have also been kept as projects and projects. Programs to increase production capacity should be considered as projects and projects only. This makes it clear what our priorities are, which projects to prioritize, and why. There is no clarity even in the projects of national pride. The main problem is that it is not clear what we are allocating the budget for.

The Commission for Investigation of Abuse of Authority has also released a report stating that hundreds of our projects are sick. But the budget is constantly going to him. Even useless projects were not scrapped. The continuity of unwanted projects has created problems in the budgetary system itself. The five-year project has not been completed in 10 years. The project which was supposed to be completed at a cost of Rs 50 million has not been completed even after spending Rs 100 million. 40/50 percent of the project budget can be cut. The cut budget can be spent on other good and productive sectors. On the other hand, various funds are being spent indiscriminately. Study, The trend of announcing various programs in the budget without conducting research and making laws has not stopped. A budget of Rs 135 billion is stuck in such funds. The Office of the Auditor General has said this every year. The budget that should not be given to the parliamentarians in the name of constituency was also given continuity. The program was continued in such a way that the federal parliamentarians would also spend such money and the states would also do the same. The budget has been allocated for agriculture, industry, employment and road related programs in a double and triple manner. There is also a program to transfer at the state and local level.

All the employment and relief programs mentioned in the budget have to be done by others. There is no concrete program for relief. Apart from tax and electricity tariff exemptions and facilities, Rs 50 billion will be spent on budget relief. It is also said that a fund of Rs. 50 billion will be mobilized through NRB. The budget did not come in line with the depth and adversity of the current crisis. The removal program was continued, with the state not paying attention to the areas it was supposed to protect. Many countries brought relief programs but our government backed down. The budget was brought in assuming that the situation would return to normal in a short time. Therefore, the budget needs to be reconsidered. The transition is spreading, many Nepalis are returning from abroad, there is still uncertainty on many issues, so the government should think seriously and in a new way.

Does reconsideration mean that the government will bring a new program by any means or will it bring another budget?

Where to get resources to bring new programs? Resources cannot be mobilized without reconsidering the budget. The money for the programs already provided in the budget cannot be circulated. We have to think from a new vein in view of the depth of the crisis.

You indicated that another new budget was needed. But the budget has been passed by the parliament and has been verified by the President. What is the way to bring another budget immediately?

There is a parliament. It is rebuilt by discussion there. There are various committees, there are structures of government, they have to work. Do it Discussions also had to take place between the parties. This is an opportunity. I said JJ problem, it is an opportunity to improve. There is no program in the budget for productive, utilizing the resources of the country and giving returns by investing. Wealth centralized facilities and unproductive sector programs should not be continued. No one is upset that there are problems. But there are methods and procedures to improve it, which must be reconsidered.

We have limited resources. As you said, a lot of money is needed for the relief program. Where to raise money for that again?

The overall self-improvement of the problem I mentioned earlier involves mobilizing resources. I still say that the expenditure of Rs. 3 trillion can be cut now. Is there a need to pour money into public institutions at this time? A lot of money will be saved if the useless programs are scrapped and the budget is allocated only for result-oriented programs by setting new standards. The tendency of the center to spend large sums of money in unnecessary or unproductive areas has also increased at the state and local levels. This can lead to major accidents in the long run. Therefore, it is necessary to control the expenditure at all the three levels, determine the pre-priorities and make immediate, medium and long term action plans. At the same time, we need to strategically loosen the economy. Which we are doing. Within that, initiatives should also be taken to formalize the informal sector. That will increase some revenue. According to a study done on value added tax (VAT), there is a lot of tax evasion. If it can be stopped, it is possible to mobilize more resources. An important feature of Nepal's economy is the parallel economy (black business).

Another option is to raise funds from international donors.

That is possible. The IMF has provided Rapid Credit Facility (RCF) facility only a few years ago to reduce the impact of COVID-19. The World Bank is giving the same amount. Experts in the European system or in the West are saying that a low-income country like Nepal needs देखि 1.5 to ट 2 trillion to recover from the Covid-19 crisis. This is a global crisis. It should be taken as such. But we see it as a crisis. We are moving forward with high economic growth, everything is going to be normal.

The United States dominates the world market. In the past, the United Kingdom has opposed the US dollar as an international currency. At that time, America was more dominant. When Japan tried to move in a slightly different direction, its economy collapsed, which has yet to recover. Still can't go beyond 'stagnation'. The dollar still dominates the world market. There is no alternative. At this time, it is necessary for the IMF to issue about 2 to 2.5 trillion SDRs and make that amount available to a country like ours unconditionally. This eases the burden of debt. Institutions including the IMF and the World Bank are also trying to mobilize sufficient resources to help countries like ours.

The US aid agency Millennium Challenge Corporation (MCC) is polarized. How does it view the deteriorating environment of aid received from donor agencies?

Some serious questions have been raised about MCC. That is to say, it is above our constitutional system. This has also brought a kind of dilemma. It should be clear. At this time, all the political parties should move forward with a consensus. That money should be brought, not stopped. Failure to accept this project will send a negative message. I also have an experience of which. When Madhav Kumar was Nepal's foreign minister, I went to Europe on a visit. In a discussion with the UK Minister for Development, she asked the first question: It also affects bilateral relations, doesn't it? ' The US dominates the World Bank more than the IMF. The US has a tendency to take ego. That could have a detrimental effect on the future.

What should the next monetary policy look like?

NRB seems to have to implement many of the programs announced in the budget through monetary policy. Monetary policy has been 'overburdened'. However, many problems need to be addressed through monetary policy. At present, due to the external dependence from which the economy has run, there is no employment in the country and the resources here are not being used. It is linked to monetary policy as well as fiscal policy. To invest in areas where quick returns come, remittances come, deposits in banks, banks invest in trade or other unproductive sectors, There are also problems in the credit facility, including the dominance of a limited number of people. Therefore, structural reforms are needed here as well. Small businesses that need special money have not received the facility. Most of the loans seem to be concentrated in the Kathmandu Valley. The loan facility of 5 percent interest subsidy operated by the government has not reached the farmers yet. There should be a slight structural change during this crisis. In terms of policy, monetary policy is not linked to economic growth. In a country like ours, monetary policy should also be linked to economic growth. To be associated with growth means to be associated with the supply side. Price is a monetary phenomenon. It looks at the overall demand. This is not a bad thing at all. The nations of the West have also embraced it. At the same time, monetary policy must now be linked to growth and the supply side of production. Monetary policy should also be linked to economic growth. To be associated with growth means to be associated with the supply side. Price is a monetary phenomenon. It looks at the overall demand. This is not a bad thing at all. The nations of the West have also embraced it. At the same time, monetary policy must now be linked to growth and the supply side of production. Monetary policy should also be linked to economic growth. To be associated with growth means to be associated with the supply side. Price is a monetary phenomenon. It looks at the overall demand. This is not a bad thing at all. The nations of the West have also embraced it. At the same time, monetary policy must now be linked to growth and the supply side of production.

The interest payment period will definitely be extended through monetary policy. There should also be a policy to encourage savings. Remittances from the formal system are declining. That should be increased. Shadow banking has flourished. There is a lot of money out of the system. The flow of unofficial routes has not been stopped. It is not possible to say how much money is in the economy and in which sector it is being used. This has added to the challenge of monetary policy. The status of monetary policy has been questioned. To prevent this, we should take initiative to bring in as many remittances as possible from the banking system. Cashless transactions should be encouraged. In the past, there were many problems in the financial system. The banking system itself was in a state of collapse. Up to 60 percent of the World Bank's credit facilities were bad loans from banks and financial institutions. Learning from these situations, the monetary policy should be able to create an environment where even small farmers, poor and marginalized communities can take loans.

NRB can flow money into the market by purchasing private sector assets. It has started in India. Since the 2008 crisis, nations in the West have been sending money to the market every year through quantitative easing (QE). Private sector assets can also be purchased through QI. Now when buying private property in troubled areas, liquidity flows in the market and bad loans of banks do not increase. The central banks of developed countries seem to have adopted the same process. There is a situation that government expenditure will not be incurred till mid-June. This problem is also at the state and local level. This has led to lack of liquidity in the market. To solve this problem, a time-consuming system should be developed. It is time to think about modifying the exchange rate with India.

Now is the right time to revise the stable exchange rate with India?

Not to do today. We had to raise our exchange rate. It means to make 170 or more instead of the current 160. This makes exports more expensive and encourages exports. For this, production should be increased internally. We need to increase our competitiveness so that we can survive at the international level. Otherwise, it may have more negative effects. I am having discussions with many Nepali counterparts working internationally on exchange rate modification with India. They are saying that now is the right time. This is not something that can be demanded by the National Bank. It is a purely political issue. It is not always possible to maintain the old exchange rate. It is meant to prepare internally, increase competitiveness and move forward by looking at the right time.

What are the other things that should not be missed in monetary policy?

First, a policy of larger savings should be introduced. For this, we have to go for 'Redirection of Monetary Policy'. Second is the maximum utilization of liquidity. Monetary policy should also address the 'liquidity of liquidity' that flows into the market. The flow of credit needs to be restructured, what is the market demand, what is the target group, what is its need. Who do not underestimate investment in productive and priority sectors. For this, the structure of the 'lending portfolio' decided by the monetary policy should be changed.

Another aspect that should not be missed is the improvement in the regulatory and supervision system of NRB. No matter how good the policy is without improving the regulation and supervision system, nothing will happen. The new monetary policy should also include provisions for 'digitization' of the financial sector and promotion of cashless transactions.

What should be done in the monetary policy to make the concessional loan program including agriculture effective?

The nation has spent Rs 11 billion on agricultural subsidies. The main question is who got that facility. Therefore, this is not the only side of Rashtra Bank. This also applies to the government's budget. Arrangement has been made to bring the budget on May 30 so that the budget can be implemented from the beginning of the fiscal year. But have the budget programs been implemented since July 1? It became a 'zero sum game'. It also had to be mapped. Not just by announcing policies and programs. Its effective implementation had to be ensured. The body that implements monetary policy should be taken accordingly.

No comments